ev charger tax credit federal

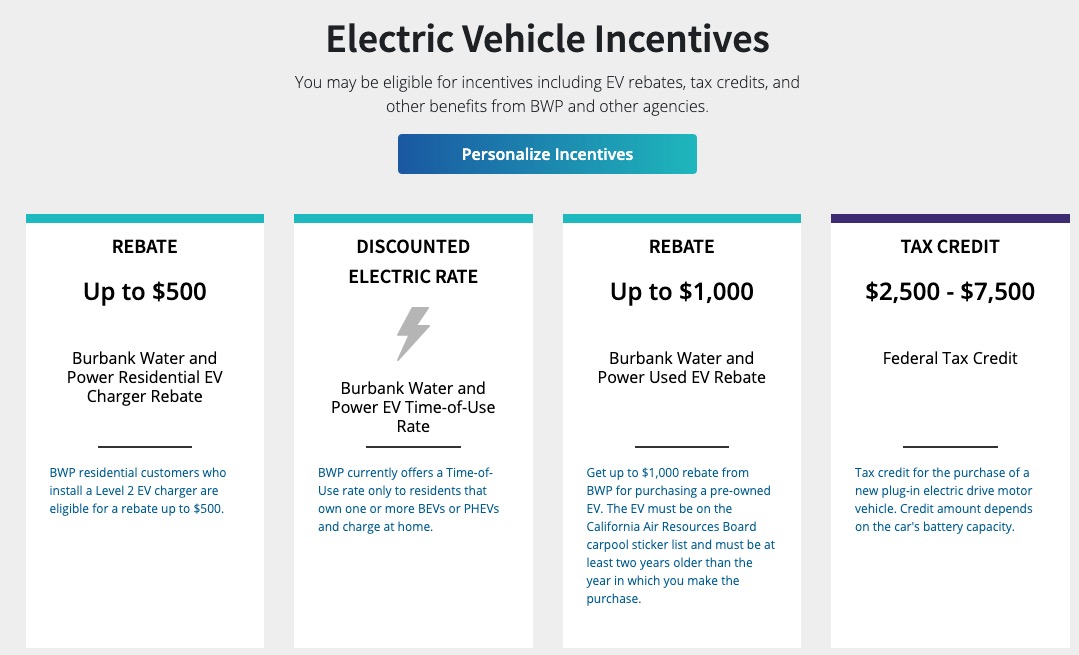

Browse reviews directions phone numbers and more info on Tax Credits LLC. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

The credit is for 30 of the combined cost of the hardware and installation capped at 1000.

. The new 7500 EV tax credit formally. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Federal Tax Credit Up To 7500.

Hawaii plans to install 11 electric vehicle fast chargers along highways statewide the state Department of. Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric vehicles. EV tax credit for new vehicles EV tax credit for used vehicles EV charger credit Frequently Asked Questions.

In addition to local. Maine electric vehicle rebates. Under the current version of the electric vehicle charging incentive businesses can receive federal tax credit for 30 of total project fees up to 30000 and excluding.

This is the same as what it used to be. 2 days agoBy Sophia Compton - Reporter. Iowa EV tax rebate.

Tax Credits LLC can be contacted at 732 885-2930. Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost. October 05 2022 1237pm HST.

The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022. Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854. District of Columbia DC offers electric vehicle tax exemptions instead of credit.

This has nothing to do with the utility. Illinois offers a 4000 electric vehicle rebate instead of a tax credit. Florida electric vehicle rebates.

The credit begins to phase out for a manufacturer when that manufacturer sells. Illinois offers a 4000 electric vehicle rebate instead of a tax credit. With the passage of the IRA the maximum.

The credit amount will. EV tax credit for new vehicles. Get Tax Credits LLC reviews ratings business hours phone.

Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of. Heres a summary of electric vehicle incentives by state.

Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation. Maryland offers a tax credit up to 3000 for qualified. Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. This incentive covers 30 of the cost with.

The Federal Tax Credit For Electric Vehicle Chargers Is Back Eq Mag Pro The Leading Solar Magazine In India

Electric Vehicle Incentives Are Getting A Total Makeover The Boston Globe

How To Choose The Right Ev Charger For You Forbes Wheels

Charged Evs Us Budget Deal Reinstates Ev Charging Station Tax Credit Charged Evs

Federal Tax Credit For Ev Charging Stations Installation Extended

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

With Millions In Federal Investment Wisconsin Weighs Strategy To Expand Electric Vehicle Infrastructure Wisconsin Public Radio

Tax Credits De Co Drive Electric Colorado

This New Incentive Helps Pay For Your Next Electric Vehicle Here S The Catch Pbs Newshour

Ev Tax Credit Expansion Still On Hold Carsdirect

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Here S How To Take Advantage Of The New Federal Ev Tax Credits Edmunds

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Ev Tax Credit May Be Out Of Reach For Most Consumers Roll Call